Collection of Brazil icms pis cofins ~ As Brazilian law still does not translate this definitively the taxpayer who is interested in excluding the ICMS from the calculation will need to file a lawsuit. The contribution for the Financing of Social Security COFINS and the Social Integration.

as we know it lately has been searched by users around us, perhaps one of you. People are now accustomed to using the net in gadgets to see image and video data for inspiration, and according to the title of this post I will discuss about Brazil Icms Pis Cofins De que forma devo cadastrar o valor do ICMS EXCLUIDO da base de calculo do PIS e da COFINS após a decisão do STF estou fazendo o abatimento direto na emissão da nota fiscal e gerando o SPED CONTRIBUIÇÕES ja com o valor abatido no momento de cálculos os impostos também.

Brazil icms pis cofins

Collection of Brazil icms pis cofins ~ 1500000 Services all taxes incl. 1500000 Services all taxes incl. 1500000 Services all taxes incl. 1500000 Services all taxes incl. Are subject to IPI ICMS ISS PIS or COFINS in Brazil registration is compulsory. Are subject to IPI ICMS ISS PIS or COFINS in Brazil registration is compulsory. Are subject to IPI ICMS ISS PIS or COFINS in Brazil registration is compulsory. Are subject to IPI ICMS ISS PIS or COFINS in Brazil registration is compulsory. Brazil 21 May 2021 In a decision issued 13 May 2021 the Brazilian Supreme Federal Court ruled on the right of taxpayers to claim a refund in relation to the inclusion of state value added tax ICMS in the basis for calculating the Contribution for the Social Integration Program PIS and the Contribution for the Financing of Social Security COFINS. Brazil 21 May 2021 In a decision issued 13 May 2021 the Brazilian Supreme Federal Court ruled on the right of taxpayers to claim a refund in relation to the inclusion of state value added tax ICMS in the basis for calculating the Contribution for the Social Integration Program PIS and the Contribution for the Financing of Social Security COFINS. Brazil 21 May 2021 In a decision issued 13 May 2021 the Brazilian Supreme Federal Court ruled on the right of taxpayers to claim a refund in relation to the inclusion of state value added tax ICMS in the basis for calculating the Contribution for the Social Integration Program PIS and the Contribution for the Financing of Social Security COFINS. Brazil 21 May 2021 In a decision issued 13 May 2021 the Brazilian Supreme Federal Court ruled on the right of taxpayers to claim a refund in relation to the inclusion of state value added tax ICMS in the basis for calculating the Contribution for the Social Integration Program PIS and the Contribution for the Financing of Social Security COFINS.

Program PIS levy on the revenues received by the Brazilian legal entities under private law in general including those similar to them by the law of income tax except for micro-enterprises and small businesses subject to the regime of the National. Program PIS levy on the revenues received by the Brazilian legal entities under private law in general including those similar to them by the law of income tax except for micro-enterprises and small businesses subject to the regime of the National. Program PIS levy on the revenues received by the Brazilian legal entities under private law in general including those similar to them by the law of income tax except for micro-enterprises and small businesses subject to the regime of the National. Program PIS levy on the revenues received by the Brazilian legal entities under private law in general including those similar to them by the law of income tax except for micro-enterprises and small businesses subject to the regime of the National. The Courts latest ruling confirms the methodology for calculating the PIS and COFINS. The Courts latest ruling confirms the methodology for calculating the PIS and COFINS. The Courts latest ruling confirms the methodology for calculating the PIS and COFINS. The Courts latest ruling confirms the methodology for calculating the PIS and COFINS. If a business supplies goods andor services that are subject to IPI ICMS ISS PIS or COFINS in Brazil registration is compulsory. If a business supplies goods andor services that are subject to IPI ICMS ISS PIS or COFINS in Brazil registration is compulsory. If a business supplies goods andor services that are subject to IPI ICMS ISS PIS or COFINS in Brazil registration is compulsory. If a business supplies goods andor services that are subject to IPI ICMS ISS PIS or COFINS in Brazil registration is compulsory.

For this reason ICMS cannot be included in the PIS and Cofins assessment basis. For this reason ICMS cannot be included in the PIS and Cofins assessment basis. For this reason ICMS cannot be included in the PIS and Cofins assessment basis. For this reason ICMS cannot be included in the PIS and Cofins assessment basis. With the decision of the STF in 2021 it became clear that the taxpayer must deduct the ICMS value from the revenue in order to have the PIS and COFINS calculation basis Brazil. With the decision of the STF in 2021 it became clear that the taxpayer must deduct the ICMS value from the revenue in order to have the PIS and COFINS calculation basis Brazil. With the decision of the STF in 2021 it became clear that the taxpayer must deduct the ICMS value from the revenue in order to have the PIS and COFINS calculation basis Brazil. With the decision of the STF in 2021 it became clear that the taxpayer must deduct the ICMS value from the revenue in order to have the PIS and COFINS calculation basis Brazil. After almost ten years on stand-by on March 15 2017 the Supreme Court of Justice STF on the Extraordinary Appeal RE 574706 with recognition of general repercussion over the subject decided that ICMS State VAT should not be included on the tax basis of contributions PIS and COFINS. After almost ten years on stand-by on March 15 2017 the Supreme Court of Justice STF on the Extraordinary Appeal RE 574706 with recognition of general repercussion over the subject decided that ICMS State VAT should not be included on the tax basis of contributions PIS and COFINS. After almost ten years on stand-by on March 15 2017 the Supreme Court of Justice STF on the Extraordinary Appeal RE 574706 with recognition of general repercussion over the subject decided that ICMS State VAT should not be included on the tax basis of contributions PIS and COFINS. After almost ten years on stand-by on March 15 2017 the Supreme Court of Justice STF on the Extraordinary Appeal RE 574706 with recognition of general repercussion over the subject decided that ICMS State VAT should not be included on the tax basis of contributions PIS and COFINS.

Federal Supreme Court rules on PIS and COFINS calculation base in Brazil. Federal Supreme Court rules on PIS and COFINS calculation base in Brazil. Federal Supreme Court rules on PIS and COFINS calculation base in Brazil. Federal Supreme Court rules on PIS and COFINS calculation base in Brazil. The Opinion which is yet to be confirmed or. The Opinion which is yet to be confirmed or. The Opinion which is yet to be confirmed or. The Opinion which is yet to be confirmed or. Businesses are required to separately register for ICMS in each state and ISS in each city where they have any kind of establishment. Businesses are required to separately register for ICMS in each state and ISS in each city where they have any kind of establishment. Businesses are required to separately register for ICMS in each state and ISS in each city where they have any kind of establishment. Businesses are required to separately register for ICMS in each state and ISS in each city where they have any kind of establishment.

Brazils Supreme Court STF issued a decision on 13 May 2021 that lays to rest a nearly 20-year old debate in the national courts as to whether VAT levied by the Brazilian states on the sale of goods ICMS should be included in the tax base of two federal taxes levied on gross revenue ie. Brazils Supreme Court STF issued a decision on 13 May 2021 that lays to rest a nearly 20-year old debate in the national courts as to whether VAT levied by the Brazilian states on the sale of goods ICMS should be included in the tax base of two federal taxes levied on gross revenue ie. Brazils Supreme Court STF issued a decision on 13 May 2021 that lays to rest a nearly 20-year old debate in the national courts as to whether VAT levied by the Brazilian states on the sale of goods ICMS should be included in the tax base of two federal taxes levied on gross revenue ie. Brazils Supreme Court STF issued a decision on 13 May 2021 that lays to rest a nearly 20-year old debate in the national courts as to whether VAT levied by the Brazilian states on the sale of goods ICMS should be included in the tax base of two federal taxes levied on gross revenue ie. There is no threshold below which a business is not required to account for these taxes. There is no threshold below which a business is not required to account for these taxes. There is no threshold below which a business is not required to account for these taxes. There is no threshold below which a business is not required to account for these taxes. Businesses are required to separately register for ICMS in each state and ISS in each city where it has any kind of establishment. Businesses are required to separately register for ICMS in each state and ISS in each city where it has any kind of establishment. Businesses are required to separately register for ICMS in each state and ISS in each city where it has any kind of establishment. Businesses are required to separately register for ICMS in each state and ISS in each city where it has any kind of establishment.

About this page This is a preview of a SAP Knowledge Base Article. About this page This is a preview of a SAP Knowledge Base Article. About this page This is a preview of a SAP Knowledge Base Article. About this page This is a preview of a SAP Knowledge Base Article. 1920000 Rate of COFINS. 1920000 Rate of COFINS. 1920000 Rate of COFINS. 1920000 Rate of COFINS. Click more to access the full version on SAP ONE Support launchpad Login required. Click more to access the full version on SAP ONE Support launchpad Login required. Click more to access the full version on SAP ONE Support launchpad Login required. Click more to access the full version on SAP ONE Support launchpad Login required.

10 addressing the ruling issued by the Federal Supreme Court STF in Extraordinary Appeal no. 10 addressing the ruling issued by the Federal Supreme Court STF in Extraordinary Appeal no. 10 addressing the ruling issued by the Federal Supreme Court STF in Extraordinary Appeal no. 10 addressing the ruling issued by the Federal Supreme Court STF in Extraordinary Appeal no. Sale of goods in Brazil all taxes incl. Sale of goods in Brazil all taxes incl. Sale of goods in Brazil all taxes incl. Sale of goods in Brazil all taxes incl. The Brazilian tax authorities have ruled Tax Ruling 132018 23 October 2018 that companies may exclude the monthly state Value Added Tax payable ie ICMS included in the tax basis of PIS and COFINS social contributions from the tax basis of the social contributions. The Brazilian tax authorities have ruled Tax Ruling 132018 23 October 2018 that companies may exclude the monthly state Value Added Tax payable ie ICMS included in the tax basis of PIS and COFINS social contributions from the tax basis of the social contributions. The Brazilian tax authorities have ruled Tax Ruling 132018 23 October 2018 that companies may exclude the monthly state Value Added Tax payable ie ICMS included in the tax basis of PIS and COFINS social contributions from the tax basis of the social contributions. The Brazilian tax authorities have ruled Tax Ruling 132018 23 October 2018 that companies may exclude the monthly state Value Added Tax payable ie ICMS included in the tax basis of PIS and COFINS social contributions from the tax basis of the social contributions.

574706 in which the Court confirmed that the ICMS indicated in the invoices levied on the sales should be excluded from the basis of PIS and COFINS. 574706 in which the Court confirmed that the ICMS indicated in the invoices levied on the sales should be excluded from the basis of PIS and COFINS. 574706 in which the Court confirmed that the ICMS indicated in the invoices levied on the sales should be excluded from the basis of PIS and COFINS. 574706 in which the Court confirmed that the ICMS indicated in the invoices levied on the sales should be excluded from the basis of PIS and COFINS. Total basis for calculation a b c. Total basis for calculation a b c. Total basis for calculation a b c. Total basis for calculation a b c. Brazilian Federal Revenue Service enacts Ruling comprising procedures regarding the Supreme Courts decision that excluded ICMS from PISCOFINS tax basis. Brazilian Federal Revenue Service enacts Ruling comprising procedures regarding the Supreme Courts decision that excluded ICMS from PISCOFINS tax basis. Brazilian Federal Revenue Service enacts Ruling comprising procedures regarding the Supreme Courts decision that excluded ICMS from PISCOFINS tax basis. Brazilian Federal Revenue Service enacts Ruling comprising procedures regarding the Supreme Courts decision that excluded ICMS from PISCOFINS tax basis.

Calculation and accounting of COFINS. Calculation and accounting of COFINS. Calculation and accounting of COFINS. Calculation and accounting of COFINS. Businesses are required to separately register for ICMS in each state and ISS in each city where they have an establishment. Businesses are required to separately register for ICMS in each state and ISS in each city where they have an establishment. Businesses are required to separately register for ICMS in each state and ISS in each city where they have an establishment. Businesses are required to separately register for ICMS in each state and ISS in each city where they have an establishment. There is no threshold below which a business is not required to account for these taxes. There is no threshold below which a business is not required to account for these taxes. There is no threshold below which a business is not required to account for these taxes. There is no threshold below which a business is not required to account for these taxes.

Are subject to IPI ICMS ISS PIS or COFINS in Brazil registration is compulsory. Are subject to IPI ICMS ISS PIS or COFINS in Brazil registration is compulsory. Are subject to IPI ICMS ISS PIS or COFINS in Brazil registration is compulsory. Are subject to IPI ICMS ISS PIS or COFINS in Brazil registration is compulsory. The Brazilian Supreme Federal Court the Court on May 13 concluded the judgment of the final motion on its 2017 precedent-setting decision holding that the Brazilian State-level VAT ICMS in Portuguese should not be included in the tax base of the Federal Social Contributions on Gross Revenues PIS and COFINS. The Brazilian Supreme Federal Court the Court on May 13 concluded the judgment of the final motion on its 2017 precedent-setting decision holding that the Brazilian State-level VAT ICMS in Portuguese should not be included in the tax base of the Federal Social Contributions on Gross Revenues PIS and COFINS. The Brazilian Supreme Federal Court the Court on May 13 concluded the judgment of the final motion on its 2017 precedent-setting decision holding that the Brazilian State-level VAT ICMS in Portuguese should not be included in the tax base of the Federal Social Contributions on Gross Revenues PIS and COFINS. The Brazilian Supreme Federal Court the Court on May 13 concluded the judgment of the final motion on its 2017 precedent-setting decision holding that the Brazilian State-level VAT ICMS in Portuguese should not be included in the tax base of the Federal Social Contributions on Gross Revenues PIS and COFINS. Exclusion of ICMS from the PIS and COFINS tax base Rödl Partner. Exclusion of ICMS from the PIS and COFINS tax base Rödl Partner. Exclusion of ICMS from the PIS and COFINS tax base Rödl Partner. Exclusion of ICMS from the PIS and COFINS tax base Rödl Partner.

Supreme Court confirms state VAT is excluded from calculation of the PISCOFINS tax base. Supreme Court confirms state VAT is excluded from calculation of the PISCOFINS tax base. Supreme Court confirms state VAT is excluded from calculation of the PISCOFINS tax base. Supreme Court confirms state VAT is excluded from calculation of the PISCOFINS tax base. On May 13 2021 the Brazilian Supreme Court STF concluded the trial of one of the largest tax discussions in Brazil relating to the exclusion of ICMS state sales tax in the PISCOFINS federal contribution on total revenue tax base as discussed in Challenges and complexities of the Brazilian tax system. On May 13 2021 the Brazilian Supreme Court STF concluded the trial of one of the largest tax discussions in Brazil relating to the exclusion of ICMS state sales tax in the PISCOFINS federal contribution on total revenue tax base as discussed in Challenges and complexities of the Brazilian tax system. On May 13 2021 the Brazilian Supreme Court STF concluded the trial of one of the largest tax discussions in Brazil relating to the exclusion of ICMS state sales tax in the PISCOFINS federal contribution on total revenue tax base as discussed in Challenges and complexities of the Brazilian tax system. On May 13 2021 the Brazilian Supreme Court STF concluded the trial of one of the largest tax discussions in Brazil relating to the exclusion of ICMS state sales tax in the PISCOFINS federal contribution on total revenue tax base as discussed in Challenges and complexities of the Brazilian tax system. There is no threshold below which a business is not required to account for these taxes. There is no threshold below which a business is not required to account for these taxes. There is no threshold below which a business is not required to account for these taxes. There is no threshold below which a business is not required to account for these taxes.

Brazils Federal Supreme Court STF ruled by a vote of six to four on 15 March 2017 that the inclusion of the ICMS state VAT tax collected by a taxpayer in the taxpayers PIS and COFINS federal social contributions calculation base is unconstitutional. Brazils Federal Supreme Court STF ruled by a vote of six to four on 15 March 2017 that the inclusion of the ICMS state VAT tax collected by a taxpayer in the taxpayers PIS and COFINS federal social contributions calculation base is unconstitutional. Brazils Federal Supreme Court STF ruled by a vote of six to four on 15 March 2017 that the inclusion of the ICMS state VAT tax collected by a taxpayer in the taxpayers PIS and COFINS federal social contributions calculation base is unconstitutional. Brazils Federal Supreme Court STF ruled by a vote of six to four on 15 March 2017 that the inclusion of the ICMS state VAT tax collected by a taxpayer in the taxpayers PIS and COFINS federal social contributions calculation base is unconstitutional. PIS COFINS ICMS base exclude exclusion excluir exclusão remover Brasil Brazil cálculo liminar causa justiça KBA XX-CSC-BR-SD Sales and Distribution XX-CSC-BR-NFE Nota Fiscal Electronica Problem. PIS COFINS ICMS base exclude exclusion excluir exclusão remover Brasil Brazil cálculo liminar causa justiça KBA XX-CSC-BR-SD Sales and Distribution XX-CSC-BR-NFE Nota Fiscal Electronica Problem. PIS COFINS ICMS base exclude exclusion excluir exclusão remover Brasil Brazil cálculo liminar causa justiça KBA XX-CSC-BR-SD Sales and Distribution XX-CSC-BR-NFE Nota Fiscal Electronica Problem. PIS COFINS ICMS base exclude exclusion excluir exclusão remover Brasil Brazil cálculo liminar causa justiça KBA XX-CSC-BR-SD Sales and Distribution XX-CSC-BR-NFE Nota Fiscal Electronica Problem. The Brazilian tax authorities have ruled Tax Ruling 132018 23 October 2018 that companies may exclude the monthly state Value Added Tax payable ie ICMS included in the tax basis of PIS and COFINS social contributions from the tax basis of the social contributions. The Brazilian tax authorities have ruled Tax Ruling 132018 23 October 2018 that companies may exclude the monthly state Value Added Tax payable ie ICMS included in the tax basis of PIS and COFINS social contributions from the tax basis of the social contributions. The Brazilian tax authorities have ruled Tax Ruling 132018 23 October 2018 that companies may exclude the monthly state Value Added Tax payable ie ICMS included in the tax basis of PIS and COFINS social contributions from the tax basis of the social contributions. The Brazilian tax authorities have ruled Tax Ruling 132018 23 October 2018 that companies may exclude the monthly state Value Added Tax payable ie ICMS included in the tax basis of PIS and COFINS social contributions from the tax basis of the social contributions.

Então tenho 2 questões uma deles diz respeito ao valor da base de calculo visto que trata-se de uma. Então tenho 2 questões uma deles diz respeito ao valor da base de calculo visto que trata-se de uma. Então tenho 2 questões uma deles diz respeito ao valor da base de calculo visto que trata-se de uma. Então tenho 2 questões uma deles diz respeito ao valor da base de calculo visto que trata-se de uma. VATGST registration Is voluntary registration for VATGST and other indirect taxes. VATGST registration Is voluntary registration for VATGST and other indirect taxes. VATGST registration Is voluntary registration for VATGST and other indirect taxes. VATGST registration Is voluntary registration for VATGST and other indirect taxes. The Brazilian Federal Revenue has issued Opinion No. The Brazilian Federal Revenue has issued Opinion No. The Brazilian Federal Revenue has issued Opinion No. The Brazilian Federal Revenue has issued Opinion No.

The exclusion of state VAT ICMS from the calculation basis of the federal contributions on total revenue PISCOFINS known as the thesis of the century among lawyers businessmen and the media ended on May 13 2021 when after a succession of postponements the Brazilian Supreme Court STF modulated the effects of the first decision handed down in 2017. The exclusion of state VAT ICMS from the calculation basis of the federal contributions on total revenue PISCOFINS known as the thesis of the century among lawyers businessmen and the media ended on May 13 2021 when after a succession of postponements the Brazilian Supreme Court STF modulated the effects of the first decision handed down in 2017. The exclusion of state VAT ICMS from the calculation basis of the federal contributions on total revenue PISCOFINS known as the thesis of the century among lawyers businessmen and the media ended on May 13 2021 when after a succession of postponements the Brazilian Supreme Court STF modulated the effects of the first decision handed down in 2017. The exclusion of state VAT ICMS from the calculation basis of the federal contributions on total revenue PISCOFINS known as the thesis of the century among lawyers businessmen and the media ended on May 13 2021 when after a succession of postponements the Brazilian Supreme Court STF modulated the effects of the first decision handed down in 2017.

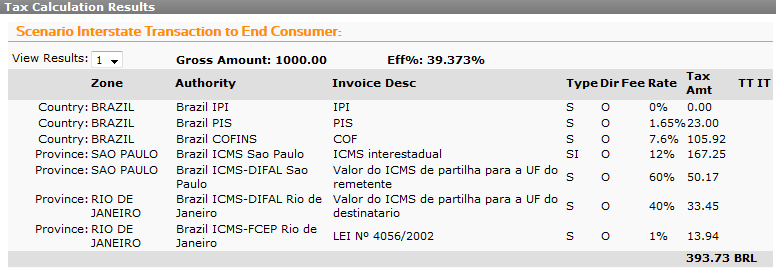

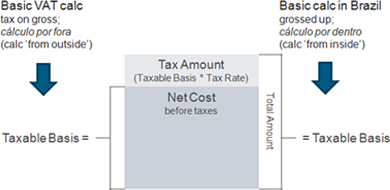

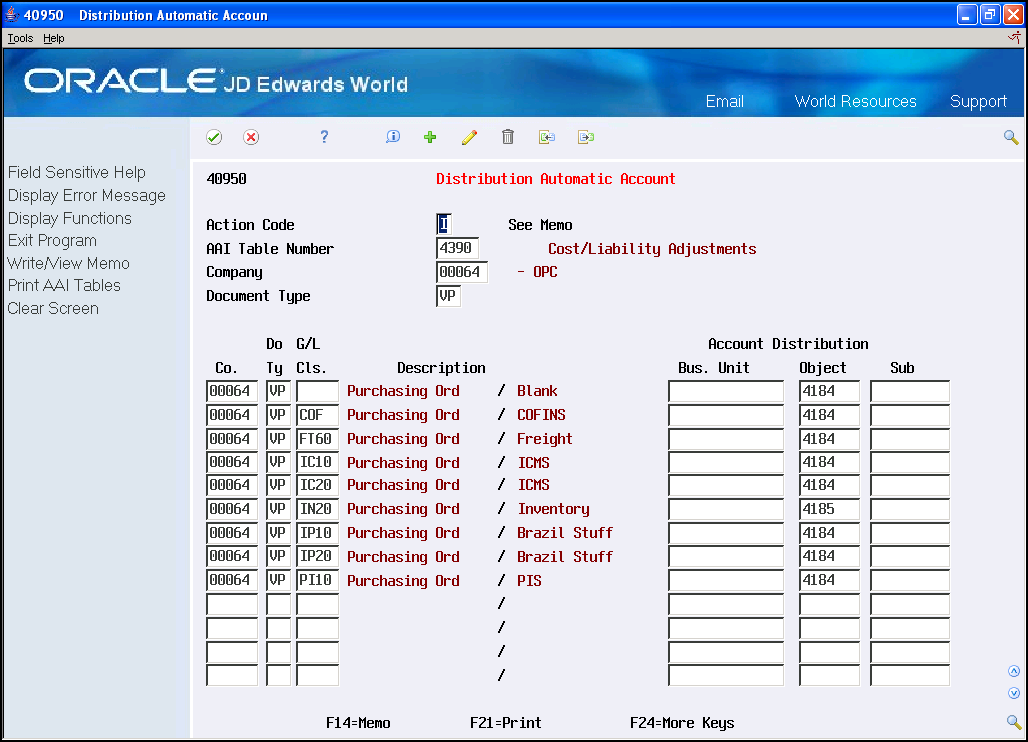

Brazil Tax Calculations

Source Image @ sabic.hostedtax.thomsonreuters.com

Brazil icms pis cofins | Brazil Tax Calculations

Collection of Brazil icms pis cofins ~ 1500000 Services all taxes incl. 1500000 Services all taxes incl. 1500000 Services all taxes incl. Are subject to IPI ICMS ISS PIS or COFINS in Brazil registration is compulsory. Are subject to IPI ICMS ISS PIS or COFINS in Brazil registration is compulsory. Are subject to IPI ICMS ISS PIS or COFINS in Brazil registration is compulsory. Brazil 21 May 2021 In a decision issued 13 May 2021 the Brazilian Supreme Federal Court ruled on the right of taxpayers to claim a refund in relation to the inclusion of state value added tax ICMS in the basis for calculating the Contribution for the Social Integration Program PIS and the Contribution for the Financing of Social Security COFINS. Brazil 21 May 2021 In a decision issued 13 May 2021 the Brazilian Supreme Federal Court ruled on the right of taxpayers to claim a refund in relation to the inclusion of state value added tax ICMS in the basis for calculating the Contribution for the Social Integration Program PIS and the Contribution for the Financing of Social Security COFINS. Brazil 21 May 2021 In a decision issued 13 May 2021 the Brazilian Supreme Federal Court ruled on the right of taxpayers to claim a refund in relation to the inclusion of state value added tax ICMS in the basis for calculating the Contribution for the Social Integration Program PIS and the Contribution for the Financing of Social Security COFINS.

Program PIS levy on the revenues received by the Brazilian legal entities under private law in general including those similar to them by the law of income tax except for micro-enterprises and small businesses subject to the regime of the National. Program PIS levy on the revenues received by the Brazilian legal entities under private law in general including those similar to them by the law of income tax except for micro-enterprises and small businesses subject to the regime of the National. Program PIS levy on the revenues received by the Brazilian legal entities under private law in general including those similar to them by the law of income tax except for micro-enterprises and small businesses subject to the regime of the National. The Courts latest ruling confirms the methodology for calculating the PIS and COFINS. The Courts latest ruling confirms the methodology for calculating the PIS and COFINS. The Courts latest ruling confirms the methodology for calculating the PIS and COFINS. If a business supplies goods andor services that are subject to IPI ICMS ISS PIS or COFINS in Brazil registration is compulsory. If a business supplies goods andor services that are subject to IPI ICMS ISS PIS or COFINS in Brazil registration is compulsory. If a business supplies goods andor services that are subject to IPI ICMS ISS PIS or COFINS in Brazil registration is compulsory.

For this reason ICMS cannot be included in the PIS and Cofins assessment basis. For this reason ICMS cannot be included in the PIS and Cofins assessment basis. For this reason ICMS cannot be included in the PIS and Cofins assessment basis. With the decision of the STF in 2021 it became clear that the taxpayer must deduct the ICMS value from the revenue in order to have the PIS and COFINS calculation basis Brazil. With the decision of the STF in 2021 it became clear that the taxpayer must deduct the ICMS value from the revenue in order to have the PIS and COFINS calculation basis Brazil. With the decision of the STF in 2021 it became clear that the taxpayer must deduct the ICMS value from the revenue in order to have the PIS and COFINS calculation basis Brazil. After almost ten years on stand-by on March 15 2017 the Supreme Court of Justice STF on the Extraordinary Appeal RE 574706 with recognition of general repercussion over the subject decided that ICMS State VAT should not be included on the tax basis of contributions PIS and COFINS. After almost ten years on stand-by on March 15 2017 the Supreme Court of Justice STF on the Extraordinary Appeal RE 574706 with recognition of general repercussion over the subject decided that ICMS State VAT should not be included on the tax basis of contributions PIS and COFINS. After almost ten years on stand-by on March 15 2017 the Supreme Court of Justice STF on the Extraordinary Appeal RE 574706 with recognition of general repercussion over the subject decided that ICMS State VAT should not be included on the tax basis of contributions PIS and COFINS.

Federal Supreme Court rules on PIS and COFINS calculation base in Brazil. Federal Supreme Court rules on PIS and COFINS calculation base in Brazil. Federal Supreme Court rules on PIS and COFINS calculation base in Brazil. The Opinion which is yet to be confirmed or. The Opinion which is yet to be confirmed or. The Opinion which is yet to be confirmed or. Businesses are required to separately register for ICMS in each state and ISS in each city where they have any kind of establishment. Businesses are required to separately register for ICMS in each state and ISS in each city where they have any kind of establishment. Businesses are required to separately register for ICMS in each state and ISS in each city where they have any kind of establishment.

Brazils Supreme Court STF issued a decision on 13 May 2021 that lays to rest a nearly 20-year old debate in the national courts as to whether VAT levied by the Brazilian states on the sale of goods ICMS should be included in the tax base of two federal taxes levied on gross revenue ie. Brazils Supreme Court STF issued a decision on 13 May 2021 that lays to rest a nearly 20-year old debate in the national courts as to whether VAT levied by the Brazilian states on the sale of goods ICMS should be included in the tax base of two federal taxes levied on gross revenue ie. Brazils Supreme Court STF issued a decision on 13 May 2021 that lays to rest a nearly 20-year old debate in the national courts as to whether VAT levied by the Brazilian states on the sale of goods ICMS should be included in the tax base of two federal taxes levied on gross revenue ie. There is no threshold below which a business is not required to account for these taxes. There is no threshold below which a business is not required to account for these taxes. There is no threshold below which a business is not required to account for these taxes. Businesses are required to separately register for ICMS in each state and ISS in each city where it has any kind of establishment. Businesses are required to separately register for ICMS in each state and ISS in each city where it has any kind of establishment. Businesses are required to separately register for ICMS in each state and ISS in each city where it has any kind of establishment.

About this page This is a preview of a SAP Knowledge Base Article. About this page This is a preview of a SAP Knowledge Base Article. About this page This is a preview of a SAP Knowledge Base Article. 1920000 Rate of COFINS. 1920000 Rate of COFINS. 1920000 Rate of COFINS. Click more to access the full version on SAP ONE Support launchpad Login required. Click more to access the full version on SAP ONE Support launchpad Login required. Click more to access the full version on SAP ONE Support launchpad Login required.

10 addressing the ruling issued by the Federal Supreme Court STF in Extraordinary Appeal no. 10 addressing the ruling issued by the Federal Supreme Court STF in Extraordinary Appeal no. 10 addressing the ruling issued by the Federal Supreme Court STF in Extraordinary Appeal no. Sale of goods in Brazil all taxes incl. Sale of goods in Brazil all taxes incl. Sale of goods in Brazil all taxes incl. The Brazilian tax authorities have ruled Tax Ruling 132018 23 October 2018 that companies may exclude the monthly state Value Added Tax payable ie ICMS included in the tax basis of PIS and COFINS social contributions from the tax basis of the social contributions. The Brazilian tax authorities have ruled Tax Ruling 132018 23 October 2018 that companies may exclude the monthly state Value Added Tax payable ie ICMS included in the tax basis of PIS and COFINS social contributions from the tax basis of the social contributions. The Brazilian tax authorities have ruled Tax Ruling 132018 23 October 2018 that companies may exclude the monthly state Value Added Tax payable ie ICMS included in the tax basis of PIS and COFINS social contributions from the tax basis of the social contributions.

574706 in which the Court confirmed that the ICMS indicated in the invoices levied on the sales should be excluded from the basis of PIS and COFINS. 574706 in which the Court confirmed that the ICMS indicated in the invoices levied on the sales should be excluded from the basis of PIS and COFINS. 574706 in which the Court confirmed that the ICMS indicated in the invoices levied on the sales should be excluded from the basis of PIS and COFINS. Total basis for calculation a b c. Total basis for calculation a b c. Total basis for calculation a b c. Brazilian Federal Revenue Service enacts Ruling comprising procedures regarding the Supreme Courts decision that excluded ICMS from PISCOFINS tax basis. Brazilian Federal Revenue Service enacts Ruling comprising procedures regarding the Supreme Courts decision that excluded ICMS from PISCOFINS tax basis. Brazilian Federal Revenue Service enacts Ruling comprising procedures regarding the Supreme Courts decision that excluded ICMS from PISCOFINS tax basis.

Calculation and accounting of COFINS. Calculation and accounting of COFINS. Calculation and accounting of COFINS. Businesses are required to separately register for ICMS in each state and ISS in each city where they have an establishment. Businesses are required to separately register for ICMS in each state and ISS in each city where they have an establishment. Businesses are required to separately register for ICMS in each state and ISS in each city where they have an establishment. There is no threshold below which a business is not required to account for these taxes. There is no threshold below which a business is not required to account for these taxes. There is no threshold below which a business is not required to account for these taxes.

Are subject to IPI ICMS ISS PIS or COFINS in Brazil registration is compulsory. Are subject to IPI ICMS ISS PIS or COFINS in Brazil registration is compulsory. Are subject to IPI ICMS ISS PIS or COFINS in Brazil registration is compulsory. The Brazilian Supreme Federal Court the Court on May 13 concluded the judgment of the final motion on its 2017 precedent-setting decision holding that the Brazilian State-level VAT ICMS in Portuguese should not be included in the tax base of the Federal Social Contributions on Gross Revenues PIS and COFINS. The Brazilian Supreme Federal Court the Court on May 13 concluded the judgment of the final motion on its 2017 precedent-setting decision holding that the Brazilian State-level VAT ICMS in Portuguese should not be included in the tax base of the Federal Social Contributions on Gross Revenues PIS and COFINS. The Brazilian Supreme Federal Court the Court on May 13 concluded the judgment of the final motion on its 2017 precedent-setting decision holding that the Brazilian State-level VAT ICMS in Portuguese should not be included in the tax base of the Federal Social Contributions on Gross Revenues PIS and COFINS. Exclusion of ICMS from the PIS and COFINS tax base Rödl Partner. Exclusion of ICMS from the PIS and COFINS tax base Rödl Partner. Exclusion of ICMS from the PIS and COFINS tax base Rödl Partner.

Supreme Court confirms state VAT is excluded from calculation of the PISCOFINS tax base. Supreme Court confirms state VAT is excluded from calculation of the PISCOFINS tax base. Supreme Court confirms state VAT is excluded from calculation of the PISCOFINS tax base. On May 13 2021 the Brazilian Supreme Court STF concluded the trial of one of the largest tax discussions in Brazil relating to the exclusion of ICMS state sales tax in the PISCOFINS federal contribution on total revenue tax base as discussed in Challenges and complexities of the Brazilian tax system. On May 13 2021 the Brazilian Supreme Court STF concluded the trial of one of the largest tax discussions in Brazil relating to the exclusion of ICMS state sales tax in the PISCOFINS federal contribution on total revenue tax base as discussed in Challenges and complexities of the Brazilian tax system. On May 13 2021 the Brazilian Supreme Court STF concluded the trial of one of the largest tax discussions in Brazil relating to the exclusion of ICMS state sales tax in the PISCOFINS federal contribution on total revenue tax base as discussed in Challenges and complexities of the Brazilian tax system. There is no threshold below which a business is not required to account for these taxes. There is no threshold below which a business is not required to account for these taxes. There is no threshold below which a business is not required to account for these taxes.

Brazils Federal Supreme Court STF ruled by a vote of six to four on 15 March 2017 that the inclusion of the ICMS state VAT tax collected by a taxpayer in the taxpayers PIS and COFINS federal social contributions calculation base is unconstitutional. Brazils Federal Supreme Court STF ruled by a vote of six to four on 15 March 2017 that the inclusion of the ICMS state VAT tax collected by a taxpayer in the taxpayers PIS and COFINS federal social contributions calculation base is unconstitutional. Brazils Federal Supreme Court STF ruled by a vote of six to four on 15 March 2017 that the inclusion of the ICMS state VAT tax collected by a taxpayer in the taxpayers PIS and COFINS federal social contributions calculation base is unconstitutional. PIS COFINS ICMS base exclude exclusion excluir exclusão remover Brasil Brazil cálculo liminar causa justiça KBA XX-CSC-BR-SD Sales and Distribution XX-CSC-BR-NFE Nota Fiscal Electronica Problem. PIS COFINS ICMS base exclude exclusion excluir exclusão remover Brasil Brazil cálculo liminar causa justiça KBA XX-CSC-BR-SD Sales and Distribution XX-CSC-BR-NFE Nota Fiscal Electronica Problem. PIS COFINS ICMS base exclude exclusion excluir exclusão remover Brasil Brazil cálculo liminar causa justiça KBA XX-CSC-BR-SD Sales and Distribution XX-CSC-BR-NFE Nota Fiscal Electronica Problem. The Brazilian tax authorities have ruled Tax Ruling 132018 23 October 2018 that companies may exclude the monthly state Value Added Tax payable ie ICMS included in the tax basis of PIS and COFINS social contributions from the tax basis of the social contributions. The Brazilian tax authorities have ruled Tax Ruling 132018 23 October 2018 that companies may exclude the monthly state Value Added Tax payable ie ICMS included in the tax basis of PIS and COFINS social contributions from the tax basis of the social contributions. The Brazilian tax authorities have ruled Tax Ruling 132018 23 October 2018 that companies may exclude the monthly state Value Added Tax payable ie ICMS included in the tax basis of PIS and COFINS social contributions from the tax basis of the social contributions.

Então tenho 2 questões uma deles diz respeito ao valor da base de calculo visto que trata-se de uma. Então tenho 2 questões uma deles diz respeito ao valor da base de calculo visto que trata-se de uma. Então tenho 2 questões uma deles diz respeito ao valor da base de calculo visto que trata-se de uma. VATGST registration Is voluntary registration for VATGST and other indirect taxes. VATGST registration Is voluntary registration for VATGST and other indirect taxes. VATGST registration Is voluntary registration for VATGST and other indirect taxes.

If you re looking for Brazil Icms Pis Cofins you've reached the ideal location. We ve got 20 images about brazil icms pis cofins including pictures, photos, pictures, backgrounds, and more. In these page, we also have number of images available. Such as png, jpg, animated gifs, pic art, symbol, black and white, translucent, etc.

Brazil Tax Calculations

Source Image @ sabic.hostedtax.thomsonreuters.com

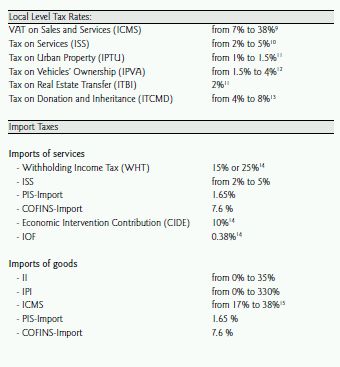

Pis And Cofins Taxes The Brazilian Vat Tax Statements In Brazil

Source Image @ www.bpc-partners.com

Corporate Income Tax Consequences Of State Vat Icms Exclusion From Pis Cofins In Brazil International Tax Review

Source Image @ www.internationaltaxreview.com

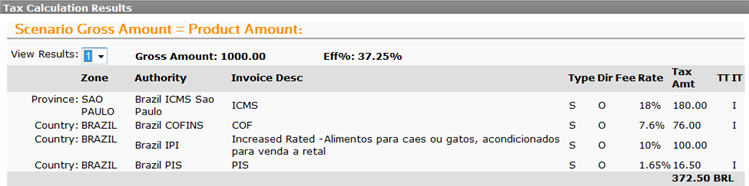

Sales Complementary Fiscal Documents For Brazil Finance Dynamics 365 Microsoft Docs

Source Image @ docs.microsoft.com

.jpg)