Collection of Brazil icms credit ~ The Brazilian Federal Revenue has issued Opinion No. ICMS is one of the most common taxes in Brazil and applies to the commercialisation of goods and services.

as we know it recently has been searched by users around us, maybe one of you. People now are accustomed to using the internet in gadgets to view image and video data for inspiration, and according to the name of the article I will talk about about Brazil Icms Credit In this particular article we will give a detailed approach to this tax focusing on what it applies to.

Brazil icms credit

Collection of Brazil icms credit ~ Understanding the ICMS tax sometimes seems an impossible mission for entrepreneurs when even experts have a hard time on this task. Understanding the ICMS tax sometimes seems an impossible mission for entrepreneurs when even experts have a hard time on this task. Understanding the ICMS tax sometimes seems an impossible mission for entrepreneurs when even experts have a hard time on this task. Understanding the ICMS tax sometimes seems an impossible mission for entrepreneurs when even experts have a hard time on this task. 360 120 BRL 240. 360 120 BRL 240. 360 120 BRL 240. 360 120 BRL 240. This rate is much smaller than the 76 that applies. This rate is much smaller than the 76 that applies. This rate is much smaller than the 76 that applies. This rate is much smaller than the 76 that applies.

The ICMS rate of 19 in Rio de Janeiro. The ICMS rate of 19 in Rio de Janeiro. The ICMS rate of 19 in Rio de Janeiro. The ICMS rate of 19 in Rio de Janeiro. ICMS incentive can be used to reduce the price of goods to the final customer as well as to capitalize the Brazilian entity ie positive PL impact. ICMS incentive can be used to reduce the price of goods to the final customer as well as to capitalize the Brazilian entity ie positive PL impact. ICMS incentive can be used to reduce the price of goods to the final customer as well as to capitalize the Brazilian entity ie positive PL impact. ICMS incentive can be used to reduce the price of goods to the final customer as well as to capitalize the Brazilian entity ie positive PL impact. On May 13 2021 the Brazilian Supreme Court STF concluded the trial of one of the largest tax discussions in Brazil relating to the exclusion of ICMS state sales tax in the PISCOFINS federal contribution on total revenue tax base as discussed in Challenges and complexities of the Brazilian tax system. On May 13 2021 the Brazilian Supreme Court STF concluded the trial of one of the largest tax discussions in Brazil relating to the exclusion of ICMS state sales tax in the PISCOFINS federal contribution on total revenue tax base as discussed in Challenges and complexities of the Brazilian tax system. On May 13 2021 the Brazilian Supreme Court STF concluded the trial of one of the largest tax discussions in Brazil relating to the exclusion of ICMS state sales tax in the PISCOFINS federal contribution on total revenue tax base as discussed in Challenges and complexities of the Brazilian tax system. On May 13 2021 the Brazilian Supreme Court STF concluded the trial of one of the largest tax discussions in Brazil relating to the exclusion of ICMS state sales tax in the PISCOFINS federal contribution on total revenue tax base as discussed in Challenges and complexities of the Brazilian tax system.

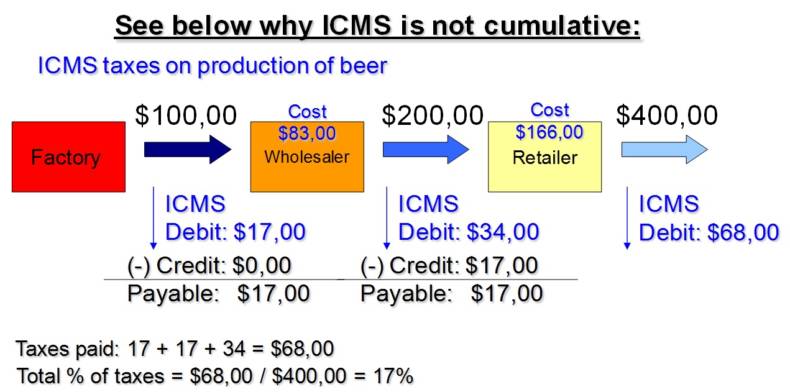

As the ICMS is calculated as a debit and credit the amount collected would look like. As the ICMS is calculated as a debit and credit the amount collected would look like. As the ICMS is calculated as a debit and credit the amount collected would look like. As the ICMS is calculated as a debit and credit the amount collected would look like. The rate applied on interstate movements of goods may vary based on the state of destination. The rate applied on interstate movements of goods may vary based on the state of destination. The rate applied on interstate movements of goods may vary based on the state of destination. The rate applied on interstate movements of goods may vary based on the state of destination. In general if certain goods or services are related to the production of goods or. In general if certain goods or services are related to the production of goods or. In general if certain goods or services are related to the production of goods or. In general if certain goods or services are related to the production of goods or.

In this article we will detail the calculation of this tax on transactions between the Brazilian states. In this article we will detail the calculation of this tax on transactions between the Brazilian states. In this article we will detail the calculation of this tax on transactions between the Brazilian states. In this article we will detail the calculation of this tax on transactions between the Brazilian states. The Brazil Business. The Brazil Business. The Brazil Business. The Brazil Business. The ruling provides details on the method for calculating the mentioned ICMS. The ruling provides details on the method for calculating the mentioned ICMS. The ruling provides details on the method for calculating the mentioned ICMS. The ruling provides details on the method for calculating the mentioned ICMS.

The Opinion which is yet to be confirmed or. The Opinion which is yet to be confirmed or. The Opinion which is yet to be confirmed or. The Opinion which is yet to be confirmed or. The IPI is normally charged at an ad valorem rate according to the classification of the. The IPI is normally charged at an ad valorem rate according to the classification of the. The IPI is normally charged at an ad valorem rate according to the classification of the. The IPI is normally charged at an ad valorem rate according to the classification of the. Definition of the input for credit purposes. Definition of the input for credit purposes. Definition of the input for credit purposes. Definition of the input for credit purposes.

Article 172 of IN 19112019 provides cases in which taxpayers may claim a credit for the PIS and COFINS collected. Article 172 of IN 19112019 provides cases in which taxpayers may claim a credit for the PIS and COFINS collected. Article 172 of IN 19112019 provides cases in which taxpayers may claim a credit for the PIS and COFINS collected. Article 172 of IN 19112019 provides cases in which taxpayers may claim a credit for the PIS and COFINS collected. SAP BRAZIL WordPress Blog 2013 to 2015. SAP BRAZIL WordPress Blog 2013 to 2015. SAP BRAZIL WordPress Blog 2013 to 2015. SAP BRAZIL WordPress Blog 2013 to 2015. Given that Brazil is a vast country logistics cost must also be considered when studying changes in the supply chain since it can kill the taxation gain. Given that Brazil is a vast country logistics cost must also be considered when studying changes in the supply chain since it can kill the taxation gain. Given that Brazil is a vast country logistics cost must also be considered when studying changes in the supply chain since it can kill the taxation gain. Given that Brazil is a vast country logistics cost must also be considered when studying changes in the supply chain since it can kill the taxation gain.

The rate of COFINS is 3 for the FORECAST method. The rate of COFINS is 3 for the FORECAST method. The rate of COFINS is 3 for the FORECAST method. The rate of COFINS is 3 for the FORECAST method. Excerpts and links may be used provided that full and clear credit is given to. Excerpts and links may be used provided that full and clear credit is given to. Excerpts and links may be used provided that full and clear credit is given to. Excerpts and links may be used provided that full and clear credit is given to. In Tax Ruling 132018 the Brazilian tax authorities state that the amount to be excluded from the social contributions tax basis is the monthly ICMS payable which already takes into consideration any credits that companies may have used or tax incentives from which the taxpayer may benefit for example. In Tax Ruling 132018 the Brazilian tax authorities state that the amount to be excluded from the social contributions tax basis is the monthly ICMS payable which already takes into consideration any credits that companies may have used or tax incentives from which the taxpayer may benefit for example. In Tax Ruling 132018 the Brazilian tax authorities state that the amount to be excluded from the social contributions tax basis is the monthly ICMS payable which already takes into consideration any credits that companies may have used or tax incentives from which the taxpayer may benefit for example. In Tax Ruling 132018 the Brazilian tax authorities state that the amount to be excluded from the social contributions tax basis is the monthly ICMS payable which already takes into consideration any credits that companies may have used or tax incentives from which the taxpayer may benefit for example.

Companies must exclude the ICMS from the contributions credits base As discussed in previous articles on March 15 2017 the Full Bench of the Brazilian Federal Supreme Court STF ruled that the inclusion of the state VAT ICMS on the social contributions on gross revenue PISCOFINS taxable base is unconstitutional Extraordinary Appeal 574706. Companies must exclude the ICMS from the contributions credits base As discussed in previous articles on March 15 2017 the Full Bench of the Brazilian Federal Supreme Court STF ruled that the inclusion of the state VAT ICMS on the social contributions on gross revenue PISCOFINS taxable base is unconstitutional Extraordinary Appeal 574706. Companies must exclude the ICMS from the contributions credits base As discussed in previous articles on March 15 2017 the Full Bench of the Brazilian Federal Supreme Court STF ruled that the inclusion of the state VAT ICMS on the social contributions on gross revenue PISCOFINS taxable base is unconstitutional Extraordinary Appeal 574706. Companies must exclude the ICMS from the contributions credits base As discussed in previous articles on March 15 2017 the Full Bench of the Brazilian Federal Supreme Court STF ruled that the inclusion of the state VAT ICMS on the social contributions on gross revenue PISCOFINS taxable base is unconstitutional Extraordinary Appeal 574706. Article 171 of IN 19112019 addresses inputs used in the production or manufacture of goods or products whose cost taxpayers may claim as a credit. Article 171 of IN 19112019 addresses inputs used in the production or manufacture of goods or products whose cost taxpayers may claim as a credit. Article 171 of IN 19112019 addresses inputs used in the production or manufacture of goods or products whose cost taxpayers may claim as a credit. Article 171 of IN 19112019 addresses inputs used in the production or manufacture of goods or products whose cost taxpayers may claim as a credit. 574706 in which the Court confirmed that the ICMS indicated in the invoices levied on the sales should be excluded from the basis of PIS and COFINS. 574706 in which the Court confirmed that the ICMS indicated in the invoices levied on the sales should be excluded from the basis of PIS and COFINS. 574706 in which the Court confirmed that the ICMS indicated in the invoices levied on the sales should be excluded from the basis of PIS and COFINS. 574706 in which the Court confirmed that the ICMS indicated in the invoices levied on the sales should be excluded from the basis of PIS and COFINS.

Unauthorized use andor duplication of this material without express and written permission from this blogs author andor owner is strictly prohibited. Unauthorized use andor duplication of this material without express and written permission from this blogs author andor owner is strictly prohibited. Unauthorized use andor duplication of this material without express and written permission from this blogs author andor owner is strictly prohibited. Unauthorized use andor duplication of this material without express and written permission from this blogs author andor owner is strictly prohibited. No wonder there is several 500-pages books clarifying how this tricky tax works on its many. No wonder there is several 500-pages books clarifying how this tricky tax works on its many. No wonder there is several 500-pages books clarifying how this tricky tax works on its many. No wonder there is several 500-pages books clarifying how this tricky tax works on its many. They have the right to deduct a credit of 76 of the amount of expenses incurred by the company and required for its activity such as goods purchased for resale raw materials used rental expenses energy expenditure or depreciation of capital from the total COFINS collected on sales. They have the right to deduct a credit of 76 of the amount of expenses incurred by the company and required for its activity such as goods purchased for resale raw materials used rental expenses energy expenditure or depreciation of capital from the total COFINS collected on sales. They have the right to deduct a credit of 76 of the amount of expenses incurred by the company and required for its activity such as goods purchased for resale raw materials used rental expenses energy expenditure or depreciation of capital from the total COFINS collected on sales. They have the right to deduct a credit of 76 of the amount of expenses incurred by the company and required for its activity such as goods purchased for resale raw materials used rental expenses energy expenditure or depreciation of capital from the total COFINS collected on sales.

ICMS is the only tax levied on interstate operations in Brazil. ICMS is the only tax levied on interstate operations in Brazil. ICMS is the only tax levied on interstate operations in Brazil. ICMS is the only tax levied on interstate operations in Brazil. The ICMS rate of 18 in São Paulo Minas Gerais and Paraná states. The ICMS rate of 18 in São Paulo Minas Gerais and Paraná states. The ICMS rate of 18 in São Paulo Minas Gerais and Paraná states. The ICMS rate of 18 in São Paulo Minas Gerais and Paraná states. The ICMS standard rate is 17. The ICMS standard rate is 17. The ICMS standard rate is 17. The ICMS standard rate is 17.

10 addressing the ruling issued by the Federal Supreme Court STF in Extraordinary Appeal no. 10 addressing the ruling issued by the Federal Supreme Court STF in Extraordinary Appeal no. 10 addressing the ruling issued by the Federal Supreme Court STF in Extraordinary Appeal no. 10 addressing the ruling issued by the Federal Supreme Court STF in Extraordinary Appeal no.

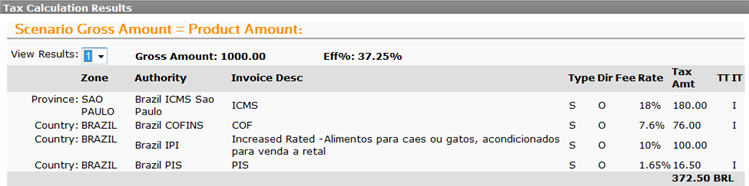

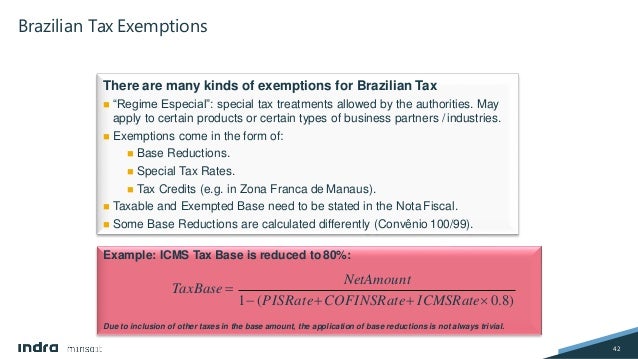

Brazil Localization Sap

Source Image @ www.slideshare.net

Brazil icms credit | Brazil Localization Sap

Collection of Brazil icms credit ~ Understanding the ICMS tax sometimes seems an impossible mission for entrepreneurs when even experts have a hard time on this task. Understanding the ICMS tax sometimes seems an impossible mission for entrepreneurs when even experts have a hard time on this task. Understanding the ICMS tax sometimes seems an impossible mission for entrepreneurs when even experts have a hard time on this task. 360 120 BRL 240. 360 120 BRL 240. 360 120 BRL 240. This rate is much smaller than the 76 that applies. This rate is much smaller than the 76 that applies. This rate is much smaller than the 76 that applies.

The ICMS rate of 19 in Rio de Janeiro. The ICMS rate of 19 in Rio de Janeiro. The ICMS rate of 19 in Rio de Janeiro. ICMS incentive can be used to reduce the price of goods to the final customer as well as to capitalize the Brazilian entity ie positive PL impact. ICMS incentive can be used to reduce the price of goods to the final customer as well as to capitalize the Brazilian entity ie positive PL impact. ICMS incentive can be used to reduce the price of goods to the final customer as well as to capitalize the Brazilian entity ie positive PL impact. On May 13 2021 the Brazilian Supreme Court STF concluded the trial of one of the largest tax discussions in Brazil relating to the exclusion of ICMS state sales tax in the PISCOFINS federal contribution on total revenue tax base as discussed in Challenges and complexities of the Brazilian tax system. On May 13 2021 the Brazilian Supreme Court STF concluded the trial of one of the largest tax discussions in Brazil relating to the exclusion of ICMS state sales tax in the PISCOFINS federal contribution on total revenue tax base as discussed in Challenges and complexities of the Brazilian tax system. On May 13 2021 the Brazilian Supreme Court STF concluded the trial of one of the largest tax discussions in Brazil relating to the exclusion of ICMS state sales tax in the PISCOFINS federal contribution on total revenue tax base as discussed in Challenges and complexities of the Brazilian tax system.

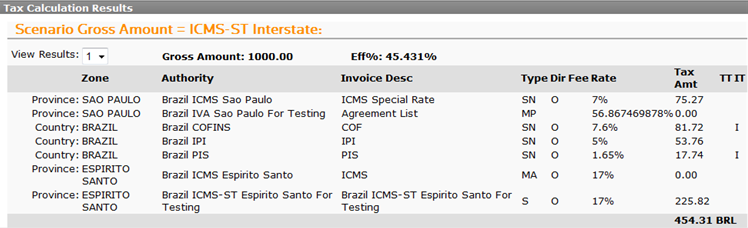

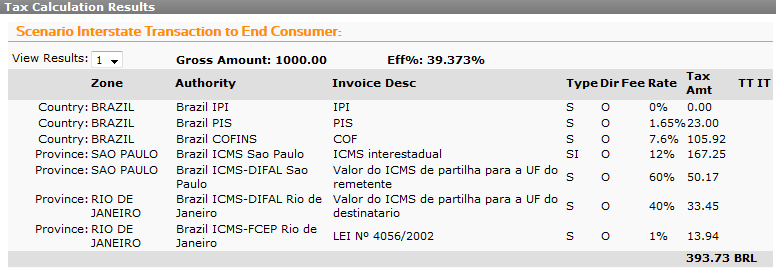

As the ICMS is calculated as a debit and credit the amount collected would look like. As the ICMS is calculated as a debit and credit the amount collected would look like. As the ICMS is calculated as a debit and credit the amount collected would look like. The rate applied on interstate movements of goods may vary based on the state of destination. The rate applied on interstate movements of goods may vary based on the state of destination. The rate applied on interstate movements of goods may vary based on the state of destination. In general if certain goods or services are related to the production of goods or. In general if certain goods or services are related to the production of goods or. In general if certain goods or services are related to the production of goods or.

In this article we will detail the calculation of this tax on transactions between the Brazilian states. In this article we will detail the calculation of this tax on transactions between the Brazilian states. In this article we will detail the calculation of this tax on transactions between the Brazilian states. The Brazil Business. The Brazil Business. The Brazil Business. The ruling provides details on the method for calculating the mentioned ICMS. The ruling provides details on the method for calculating the mentioned ICMS. The ruling provides details on the method for calculating the mentioned ICMS.

The Opinion which is yet to be confirmed or. The Opinion which is yet to be confirmed or. The Opinion which is yet to be confirmed or. The IPI is normally charged at an ad valorem rate according to the classification of the. The IPI is normally charged at an ad valorem rate according to the classification of the. The IPI is normally charged at an ad valorem rate according to the classification of the. Definition of the input for credit purposes. Definition of the input for credit purposes. Definition of the input for credit purposes.

Article 172 of IN 19112019 provides cases in which taxpayers may claim a credit for the PIS and COFINS collected. Article 172 of IN 19112019 provides cases in which taxpayers may claim a credit for the PIS and COFINS collected. Article 172 of IN 19112019 provides cases in which taxpayers may claim a credit for the PIS and COFINS collected. SAP BRAZIL WordPress Blog 2013 to 2015. SAP BRAZIL WordPress Blog 2013 to 2015. SAP BRAZIL WordPress Blog 2013 to 2015. Given that Brazil is a vast country logistics cost must also be considered when studying changes in the supply chain since it can kill the taxation gain. Given that Brazil is a vast country logistics cost must also be considered when studying changes in the supply chain since it can kill the taxation gain. Given that Brazil is a vast country logistics cost must also be considered when studying changes in the supply chain since it can kill the taxation gain.

The rate of COFINS is 3 for the FORECAST method. The rate of COFINS is 3 for the FORECAST method. The rate of COFINS is 3 for the FORECAST method. Excerpts and links may be used provided that full and clear credit is given to. Excerpts and links may be used provided that full and clear credit is given to. Excerpts and links may be used provided that full and clear credit is given to. In Tax Ruling 132018 the Brazilian tax authorities state that the amount to be excluded from the social contributions tax basis is the monthly ICMS payable which already takes into consideration any credits that companies may have used or tax incentives from which the taxpayer may benefit for example. In Tax Ruling 132018 the Brazilian tax authorities state that the amount to be excluded from the social contributions tax basis is the monthly ICMS payable which already takes into consideration any credits that companies may have used or tax incentives from which the taxpayer may benefit for example. In Tax Ruling 132018 the Brazilian tax authorities state that the amount to be excluded from the social contributions tax basis is the monthly ICMS payable which already takes into consideration any credits that companies may have used or tax incentives from which the taxpayer may benefit for example.

Companies must exclude the ICMS from the contributions credits base As discussed in previous articles on March 15 2017 the Full Bench of the Brazilian Federal Supreme Court STF ruled that the inclusion of the state VAT ICMS on the social contributions on gross revenue PISCOFINS taxable base is unconstitutional Extraordinary Appeal 574706. Companies must exclude the ICMS from the contributions credits base As discussed in previous articles on March 15 2017 the Full Bench of the Brazilian Federal Supreme Court STF ruled that the inclusion of the state VAT ICMS on the social contributions on gross revenue PISCOFINS taxable base is unconstitutional Extraordinary Appeal 574706. Companies must exclude the ICMS from the contributions credits base As discussed in previous articles on March 15 2017 the Full Bench of the Brazilian Federal Supreme Court STF ruled that the inclusion of the state VAT ICMS on the social contributions on gross revenue PISCOFINS taxable base is unconstitutional Extraordinary Appeal 574706. Article 171 of IN 19112019 addresses inputs used in the production or manufacture of goods or products whose cost taxpayers may claim as a credit. Article 171 of IN 19112019 addresses inputs used in the production or manufacture of goods or products whose cost taxpayers may claim as a credit. Article 171 of IN 19112019 addresses inputs used in the production or manufacture of goods or products whose cost taxpayers may claim as a credit. 574706 in which the Court confirmed that the ICMS indicated in the invoices levied on the sales should be excluded from the basis of PIS and COFINS. 574706 in which the Court confirmed that the ICMS indicated in the invoices levied on the sales should be excluded from the basis of PIS and COFINS. 574706 in which the Court confirmed that the ICMS indicated in the invoices levied on the sales should be excluded from the basis of PIS and COFINS.

Unauthorized use andor duplication of this material without express and written permission from this blogs author andor owner is strictly prohibited. Unauthorized use andor duplication of this material without express and written permission from this blogs author andor owner is strictly prohibited. Unauthorized use andor duplication of this material without express and written permission from this blogs author andor owner is strictly prohibited. No wonder there is several 500-pages books clarifying how this tricky tax works on its many. No wonder there is several 500-pages books clarifying how this tricky tax works on its many. No wonder there is several 500-pages books clarifying how this tricky tax works on its many. They have the right to deduct a credit of 76 of the amount of expenses incurred by the company and required for its activity such as goods purchased for resale raw materials used rental expenses energy expenditure or depreciation of capital from the total COFINS collected on sales. They have the right to deduct a credit of 76 of the amount of expenses incurred by the company and required for its activity such as goods purchased for resale raw materials used rental expenses energy expenditure or depreciation of capital from the total COFINS collected on sales. They have the right to deduct a credit of 76 of the amount of expenses incurred by the company and required for its activity such as goods purchased for resale raw materials used rental expenses energy expenditure or depreciation of capital from the total COFINS collected on sales.

ICMS is the only tax levied on interstate operations in Brazil. ICMS is the only tax levied on interstate operations in Brazil. ICMS is the only tax levied on interstate operations in Brazil. The ICMS rate of 18 in São Paulo Minas Gerais and Paraná states. The ICMS rate of 18 in São Paulo Minas Gerais and Paraná states. The ICMS rate of 18 in São Paulo Minas Gerais and Paraná states.

If you are looking for Brazil Icms Credit you've arrived at the right place. We have 20 graphics about brazil icms credit including images, photos, pictures, wallpapers, and much more. In these page, we additionally provide number of images available. Such as png, jpg, animated gifs, pic art, logo, black and white, translucent, etc.

Icms The Brazilian Tax On Commerce And Some Services Bpc Partners

Source Image @ www.bpc-partners.com

Icms St Complement And Restitution Process And Declaration For Rs Sc And Sp States Finance Dynamics 365 Microsoft Docs

Source Image @ docs.microsoft.com

Icms St Complement And Restitution Process And Declaration For Rs Sc And Sp States Finance Dynamics 365 Microsoft Docs

Source Image @ docs.microsoft.com

Icms St Complement And Restitution Process And Declaration For Rs Sc And Sp States Finance Dynamics 365 Microsoft Docs

Source Image @ docs.microsoft.com